Xpeng Motors collects $500M to develop more EVs

Xpeng, an electric vehicle start-up run by former Alibaba executive He Xiaopeng, has raised around $500 million in a new round of financing. The company says it wants to develop further models targeting tech-savvy middle-class consumers in China.

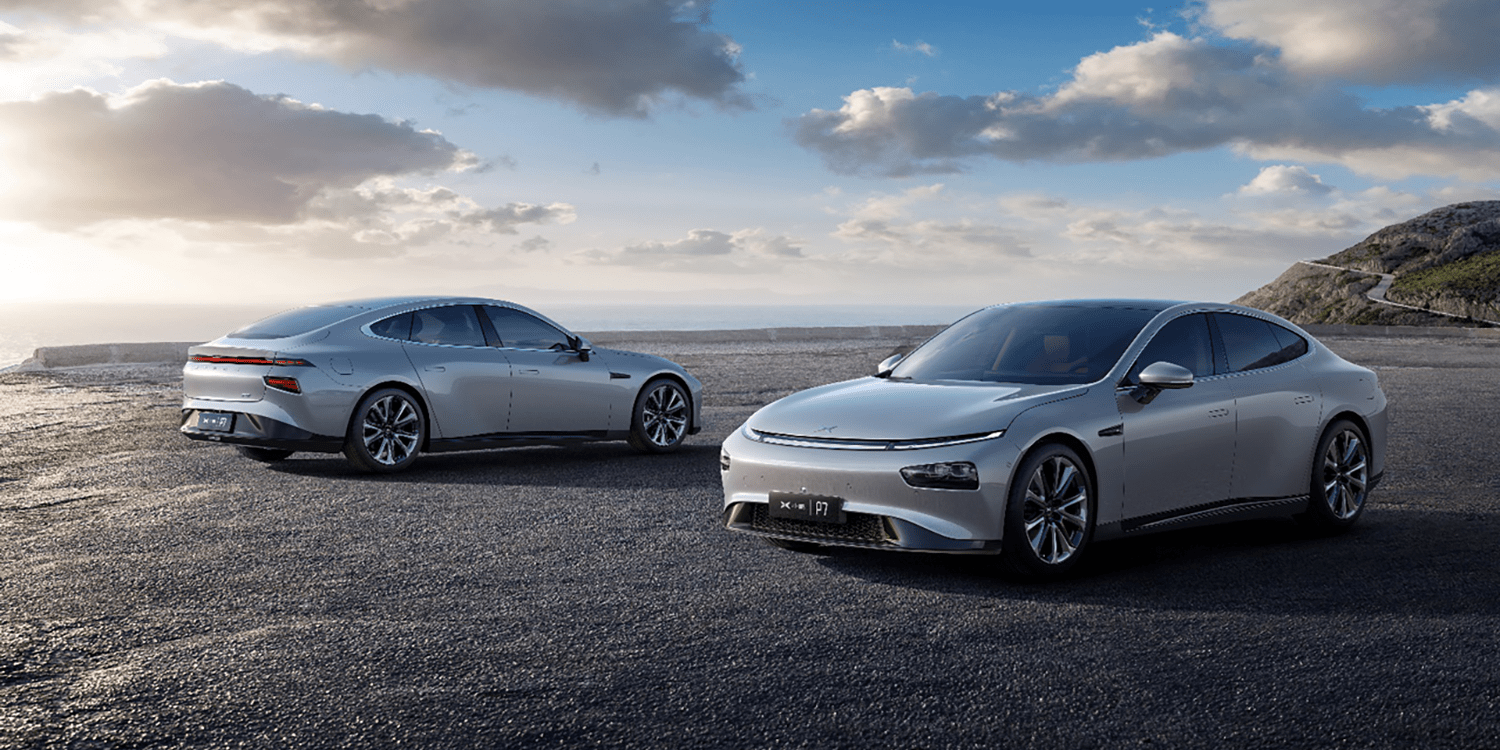

XPeng had only launched the second model in China, the P7 this June. Also the recent funding follows an earlier capital injection of over 400 million dollars last November. The five-year-old company has now raised a total of 1.7 billion dollars in its financing rounds.

The group of investors include Aspex from Hongkong, the American tech hedge fund Coatue, a leading Chinese equity fund in Hillhouse Capital, and Sequoia Capital China. They join other well-known backers such as Foxconn, Xiaomi, GGV Capital, Morningside Venture Capital, IDG Capital, and Primavera Capital.

Despite new money coming in, times in China are difficult for EV makers. The effects of Covid-19 are still felt with new energy vehicle sales recovering only slowly. Xpeng, however, claims it has so far been able to withstand coronavirus challenges. The company received the official production license from the Chinese Ministry of Industry and Information Technology in mid-May for the plant that was built in around 15 months. Also, XPeng has two all-electric cars on the market with the P7 and G3. The latter, however, is still built at the third-party factory, Haima from the time before Xpeng got the license to build electric cars.

A look at Xpeng competitors may paint a more nuanced picture of the state of EV start-ups in China at the moment. Take Byton, for example, that is essentially on the brink of bankruptcy as reported. Admittedly, Byton never managed to launch a car to sell, unlike XPeng. Also, Nio has recently reported severe financial problems. At the same time, Nio announced a new financing round only today and has since continued to launch new electric car models on its home market. Here, Nio is banking on local governments and national banks and promises to essentially create growth in turn.